Dealing with a VAT only sales adjustment in QuickBooks

If your business deals predominantly in food sales most of its sales will be 0% rated for VAT in the UK. It is the case therefore that it is simpler to record all sales as 0% and then make regular adjustments to account for the small amount of input VAT due on standard VAT sales.

A solution that we have come up with to help a farm shop business is to simplify the recording of card sales through the bank (all recorded as 0%), show them how to add daily cash sales receipts (again, all recorded as 0%), and then ask them to enter a weekly or monthly VAT only sales receipt.

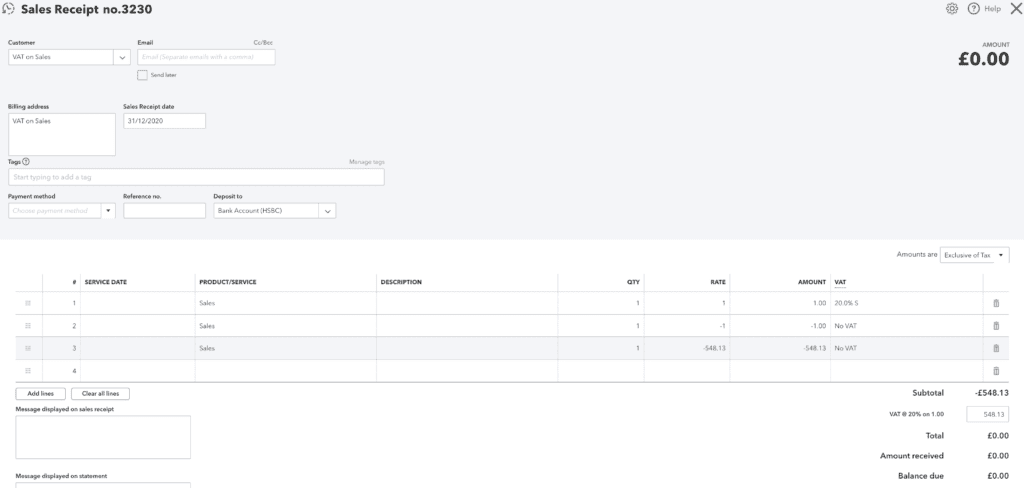

This is an example of such a receipt

There are some crucial features which must be included for this adjustment to work correctly.

What needs to be included on the VAT only sales receipt

- Sales Receipt date must be for the end of period

- Deposit To account is not important, but if set to Bank be aware that there will be a dummy entry into the bank register

- VAT default dropdown MUST be set to Exclusive of Tax

- Each line of the receipt should refer to Sales

- One line must have a positive value (£1 or £0.01 make sense) and 20%S VAT code

- A matching sum must be entered as a negative with either a No VAT or Exempt VAT code

- A third line should be added with a negative sum which matches the VAT adjustment, with a No VAT code

- Finally the VAT adjustment can be added in the VAT box below Subtotal.

Crucially, the Balance due must £0

The effect of this receipt is to increase the input tax liability (which goes into the VAT Control nominal account) and reduces the overall Sales to reflect the fact that a proportion of sales in the period was in fact VAT.